Fuel recently launched ConsumerRadar, a benchmarking tool for direct-to-consumer (D2C) startups measuring more than 50 distinct metrics. The participating startups provide Fuel with high-level acquisition and financial data, and receive a detailed report showing how they compare to a cohort of peers. Over the next few months, we’ll be sharing more insights for the broader community from these findings. For more information about participating in ConsumerRadar please click here.

The startups

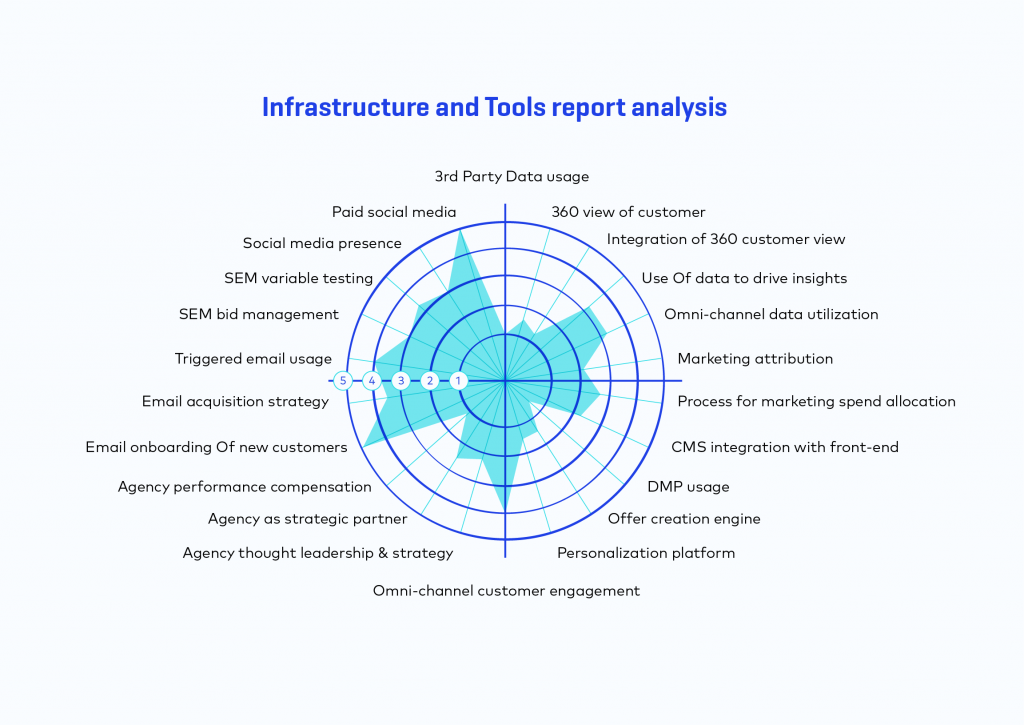

The startups came from categories that included apparel, home goods, and pet care. The group had an average founding date of 2013 and had annual revenue of $30 million in 2017. The analysis featured an infrastructure and tools survey. Participants used a 1-5 scale to self-report their perceived proficiency across 22 metrics related to data usage, marketing technology and automation, and agency relationships.

While the current data set is somewhat limited, the initial results raise some interesting questions about how D2C ecommerce startups engage customers, leverage data, and think about their marketing ROI.

Figure 1. ConsumerRadar self-reported survey (n=8), cohort results.

Scoring: 1 = low capability, 5 = high capability “Companies that focused on triggered email use and personalization, when accounting for other variables, had approximately 2X higher growth efficiency than the cohort average.”

Paid social dominates spend, but this is shifting

Unsurprisingly for D2C, the group are strong believers in paid social media (average of 4.85/5). They spend a significant portion of their budget through these channels and leverage advanced targeting options to reach specific audiences. However, many startups expressed a desire to cut back due to increasing acquisition costs coupled with diminishing returns, instead looking at less-costly channels. In many cases, companies were shifting budgets to traditional offline channels including out-of-home, radio, and direct mail – based on successful limited-geography tests.

Triggered emails and personalization drive better growth efficiency

Most of the group reported strong expertise in email marketing. The startups made email onboarding a priority, including the use of a series of personalized triggered emails within the first few weeks after purchase (4.60/5). Most also had a dedicated email strategy with always-on campaigns (4/5).

Usage was more mixed when it came to triggered emails based on certain behaviors onsite, such as abandoning a cart, and personalizing emails based on previous customer interactions (3.85). Companies that focused on triggered email use and personalization, when accounting for other variables, had approximately 2X higher growth efficiency than the cohort average.

3rd party data and leveraging agencies

None of the companies in the cohort used a DMP (Data Management Platform) to enhance the targeting of paid media (1/5). This likely stems from the high cost of setting up and managing a DMP for a startup under $100 million. Very few of the participants had set up organizational standards for managing 3rd party data (1.70/5).

The findings were mixed for agency partners. Three quarters of the startups had engaged an agency to some extent over the prior calendar year, but agencies were generally not viewed as thought leaders or strategic partners. Instead they were used mostly for execution and occasional staff augmentation (2.30/5). Whether this is a function of the early life-stage of our companies, or a sign that more marketing teams are bringing capabilities in-house is something we intend to explore further.

Moving forward

Over the next few months we would like to include more startups in the benchmarking in order to conduct a more rigorous analysis to further correlate practices with growth efficiency. If a consumer startup could benefit from a personalized report showing how it measures up against a cohort of peers across 50+ customer acquisition and business health metrics – visit here to get started.

+++

Please “Join Fuel” by clicking above and follow us on LinkedIn and Twitter for more consumer insights.